Yesterday, on the Yahoo FCX Message Board, I made the following statement:

"...The only thing that matters to me about fundamentals is the market's REACTION to them, that I can see in a chart. Analysts' opinions about what a stock "should be doing" doesn't signify with me.

One of many, many examples of why I feel that way: ... thread here this morning on US Steel (X)."

In this second decade of the 21st Century, the general response that I have received over the years, and continue to receive, to my work as a technical analyst absolutely astonishes me. Statements like, "You have to be a moron to waste your time like that on stupid charts." Or, "Technical analysis is totally useless." Or, "Technical analysis doesn't WORK."

Work? Well, no-o-o. How can something that is not human perform work, and why would anyone have that expectation in the first place?

Sadly, that ignorant attitude has been promoted by the reigning "Guru Du Jour" on television who, until recently, has been a devout technical analysis atheist. In the winter of 2011, this particular guru (who I think actually is a genius, and who I think is enormously entertaining) finally did a program entitled "The Fundamentals AND The technicals," for which I applaud him. When I say "ignorant," by the way, I simply mean "not knowing," not anything hurtful to another person, although given the nature of some of the incredibly nasty responses to my work that I have received over the years, if anyone wants to interpret "ignorant" in the pejorative sense of the word, it wouldn't be inappropriate ;)

For review, if anyone would like, see my April 2 post: "RIMM: Research In Commotion."

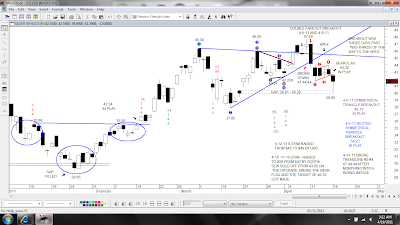

Chart is self-explanatory. Ahead of earnings, "Trading Buddy" (my idea for a technical analysis software program) had laid it out for us, and would have asked us, "SELL, or HOLD?" through the release of earnings.

The market's RESPONSE to earnings, despite at least three analysts having targets of $80, $90, and $110 based on their views of the fundamentals, was to gap RIMM down, below the neckline of a H&S Top, at which time "Trading Buddy" would have asked us, "Do you want to SELL or HOLD a technical breakdown of a three month H&S Top that has a downside target of 47.57 IN PLAY?"

We don't need "Trading Buddy" to ask ourselves, "The fundamentals are telling me that RIMM 'should be' priced above $80, according to at least three Wall Street analysts, but what I'm actually SEEING is a serious technical breakdown in the stock. Hmmm-mm...what should I do?"

After the closing gong on April 28, RIMM reduced Q1 guidance and the response of at least five analysts (early tally) who had been looking at the fundamentals and completely ignoring the serious technical breakdown in the stock, downgraded it. UGH.

Notice how "the analyst game" is played. The price quoted in the following report of the RBC downgrade (they had a target of $90) is $56.59, NOT the April 29 opening price of $48.50 that "Joe Investor" got if he sold the open on all of the downgrades. For purposes of "performance numbers," by which the analysts' recommendations are measured, that probably is how it will go into the books, at $56.59, since I've seen things get reported that way.

Research in Motion (RIMM: Nasdaq) By RBC Capital Markets ($56.59, April 29, 2011)

"We are downgrading Research in Motion to Sector Perform (from Top Pick) and reducing the price target from $90 to $55.

Our prior Top Pick rating for Research in Motion (ticker: RIMM) was based on the following: 1) fundamental value was not reflected in eight times valuation and; 2) new products restoring momentum and investor confidence.

We were wrong, as misexecution has undermined sentiment recovery. Our Sector Perform rating reflects our view that Research in Motion shares will likely remain pressured pending improved investor visibility on the ..."

The article was cut off there. Pay if you want the rest. "Um-m, no thank you."

This, from the article's Comment Section:

12:00 am ET April 30, 2011

Jeffrey L. Pritchard wrote:

"This was funny to me. Kind of makes research seem useless."

Gosh, I felt for that poor fellow. We've all "been there...done that" and know how lousy he feels. Let's not call anything "useless," but if anyone wants to insist on calling something "useless," readers can decide whether it was the technicals or the fundamentals. Personally, I don't want to call anything useless. It might be useful to someone else, and let's respect that. The analysts' opinions on their view of the particulars of the fundamentals, like the eight times valuation that they mentioned, just aren't useful to me. Let me say again, as I said yesterday:

"...The only thing that matters to me about fundamentals is the market's REACTION to them, that I can see in a chart. Analysts' opinions about what a stock "should be doing" doesn't signify with me."

We saw this breakdown of the H&S Top in US Steel, AND the failed retest of the breakdown of the neckline, prior to the release of earnings (see past posts on X).

The day after US Steel spent the entire session selling off after the release of earnings, Goldman downgraded it, from $72 to $56. We won't speculate about the possibility of Goldman selling off their shares of X during that selloff session, prior to letting their clients know about their downgrade, because that might not seem polite. We'll choose to think well of Ol' Goldman, and choose to feel certain that they allowed their clients to get out of the stock, prior to selling their own holdings after their downgrade ;)

FCX continues with its post-earnings recovery. Anything above KEY SUPPORT, "it's all good." It's a healthy digestion of the gain off the 49.71 Smackdown Low, and it's healthy backing and filling, working off the "overhang of sellers" in the stock, which we've discussed. Ideally during this backing and filling phase, the "weak-handed longs" will be worked off (they want out at a break even, and they're selling here), and the remainder of the longs who have been trapped at higher prices will hold, expecting higher prices in the stock. That's the "ideal" situation, not a prediction. I try to FOLLOW the stock, as best I can.

In keeping with today's topic ...

... sorry if this chart is a painful reminder to anyone who was long FCX through this horrific crash, but let's not forget the recent past in FCX.

(Paraphrased): "Unless we know/learn from history, we're destined to repeat it."

We can rest assured that in the Spring of 2008, there were bullish things being said about the fundamentals of FCX when it was trading in the 50's and 60's. But, we can see from the various technical breakdowns in the chart where things weren't looking so bullish.

Summary Comment: If anyone who has read this post still can tell me that technical analysis is "totally useless," I give up, not on technical analysis, I give up on trying to help that particular person to come out of his or her ignorance.*

*I mean "ignorance" in the nicest sense of the word possible, with hugs thrown in, wiping spew off a chin or two, and all of that good stuff ;)