NOTE: After you click on a chart and it appears, you can click on it again and it will enlarge. Use your left arrow at the top of your screen to get back to the narrative.

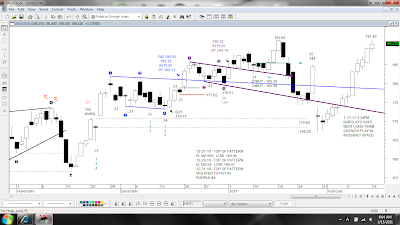

AMZN is a favorite of the short sellers and at various market junctures, the stock has squeezed them half to death. After reporting disappointing earnings after the closing bell in late January, AMZN traded as low as the $150's in after-hours trading, but it never traded that low during regular market hours. The low was 166.90 the morning after earnings were reported and the short sellers were immediately caught in a "Bear Trap," thinking that the stock had turned bearish and that it was headed much lower. Nope...

After an inside trading session the following day (meaning that the high and low were contained with the prior day's trading range), AMZN began its short squeeze. Often on internet web sites and message boards, we will read that someone is shorting a stock

because it has been up for five consecutive days, or six days, or seven days, or eight days...which is not a good reason for shorting a stock.

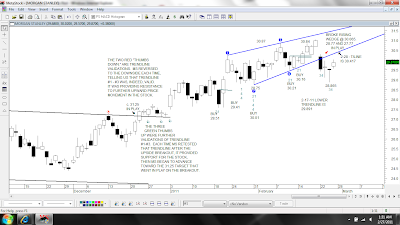

AMZN has closed higher for TEN days in a row, and yesterday, it got to within twenty cents of its January high! While it might be tempting (and even reasonable, with a tight stop-loss above the highs) to short AMZN here, looking for a Double Top at 191.60 (the January 18th high) and 191.40 (yesterday's high), we don't want to fool around with shorting a stock that is in a bullish trend if those highs get taken out to the upside. Witness: FSLR, as just one of many examples of why we don't want to do that (see the next chart).

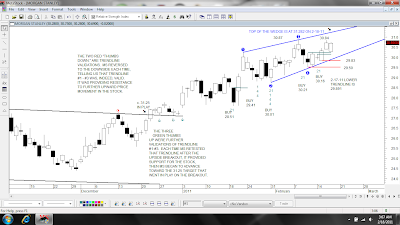

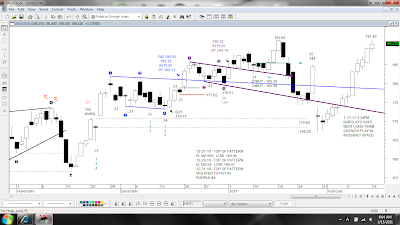

FSLR broke down out of the large Rising Wedge (the patten in blue) on October 29. That was fine to short it there, or to short the Bear Flag rally (the second red pattern) back to the broken trendline. The Rising Wedge (pattern in blue) also contained a Double Top. The breakdown put a downside target of 125.18 IN PLAY, which got MADE on November 17.

Where the Bears really got into trouble shorting, or staying short FSLR, was at the upside breakout of the Symmetrical Triangle (pattern in purple) on January 16, 2011. On January 24, FSLR rallied back to, and closed above, the October high of 153.30. Uh-oh! The Bears who didn't cover their short positions on that move to a new high got a reprieve over the next few sessions when FSLR sold off, but it came roaring back and squeezed the shorts. It made a new high yesterday of 172.30. That's 19 points higher than the October high. While that "could be" a significant high that FSLR put in yesterday, just as anything "could be"... OUCH if you're caught short a rally like that.

So, back to AMZN...shorts DON'T want to see the 191.60 and 191.40 highs get taken out to the upside!

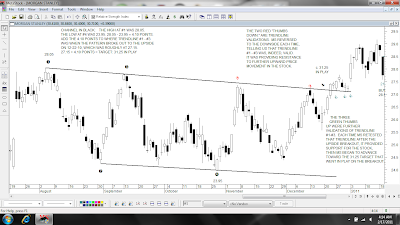

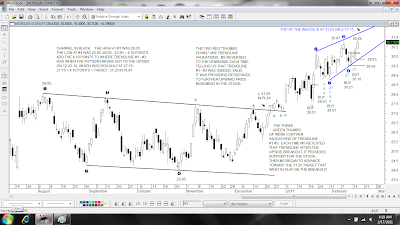

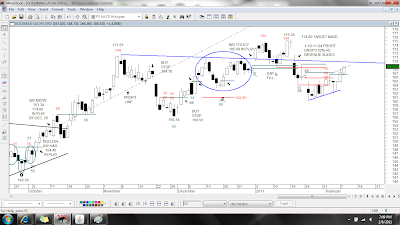

Titanium Metals (TIE) has been a bit of a devil to play since it broke out of the large Falling Wedge (pattern in blue) to the upside on January 16th. Four upside targets went IN PLAY on the breakout (listed on the chart), but TIE has had some very sharp pullbacks since the breakout.

I've played in and out of it a couple of times, last selling it in the 18.90s (see prior posts). I bought it back significantly higher last week, at 19.58 (forgot to capture a screen shot of the buy trade), because the upside targets still were IN PLAY and because TIE kept bouncing back from the sharp selloffs. The 34/55 Fibonacci RSI's (Relative Strength Indicator) also gave another Buy Signal at 19.53 late last week.

As I always say, "Take profits, or at least 'some' profits when targets get MADE." TIE finally got to Target #1, 19.95 in the early going yesterday. I considered selling only half of my position when that was achieved, but since TIE has had so many rather sharp pullbacks since the breakout, I decided to cash all of my shares in and planned to buy it back on a pullback. No luck with that strategy, which is fine. "A gain is a gain" and I'm always grateful for them. TIE was strong all session long, and went directly to target #2, 20.55.

Oh, well...

Sold at 19.93. Gain: just under $700.