THAR SHE BLOWS!! Technical breakout in XING, above 2.23. This is a relatively thinly traded stock. 100-day average volume is only 187,000, but on any technical breakout, we like to see buying interest coming in, on volume.

Nice follow-thru buying off the breakout, as the stock moved into the 2.30's...

...and, into the 2.40's and 2.50's. Very nice. Volume on the session was 1.4 million shares, the heaviest volume in XING since July, 2008, and heavier volume than the 992,000 December 9 "Gap And Crap" Reversal candle at the top of the Kumo (Cloud), seen in the next chart.

The breakout puts targets of 2.84 IN PLAY (that's the high of the December 9 "Gap And Crap" Reversal Candle), and 3.34 IN PLAY. As you know, I'm conservative about targets. When I've got choices of highs to use, and there are several in 2009, I always use the most conservative so that I'm not overly ambitious with targets. In this case, the most consevative of the highs is 2.12. It would be perfectly fine to use the 2.23 highs.

Math:

2.12 - The most conservative of the 2009 highs

0.90 - The low

2.12 - 0.90 = 1.22 points of upside above 2.12

2.12 + 1.22 = Target: 3.34 IN PLAY

Since yesterday's breakout was above the recent 2.23...2.23 resistance, and we already had broken out above 2.12, that really justifies using 2.23 to establish the target, but again, I'm consevative. Using the 2.23 high to establish the breakout target puts 3.56 IN PLAY, which is fine.

Regardless of which target we use, the target is a measured move just for this particular breakout, so it certainly doesn't mean that XING can't or won't go higher than that.

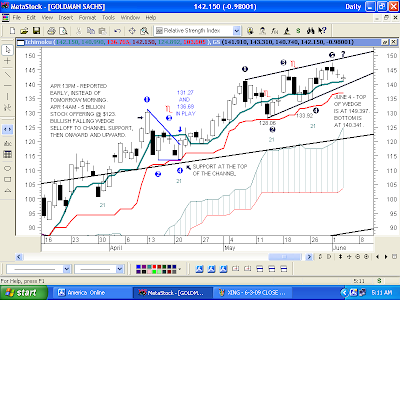

Goldman gapped down yesterday morning, from 143.13 to 141.91, below the prior day's low (white circle). I shorted it just below 142.52, the 50% retracement of the gap, but wasn't real happy to see the entire gap get filled, nor was I happy to see GS go into the green on a day when the general market was down. UGH. Don't you love it when you're short on a down day, and YOUR stock is UP?! LOL.

GS sold off to 142.00 from the morning high of 143.37, putting my trade in the green, but it rallied back to 142.97, near UNCH, while the general market remained solidly down, putting my trade back in the red. UGH.

Knowing, as we do, that this is "the stock that STUBBORNLY refuses to die," (LOL), when it sold off again late morning, but wasn't anywhere close to taking out the opening low, I wasn't willing to stay in there for another rally attempt. I threw it in for a small gain.

In the afternoon, Goldman took out the morning low, but in the final half hour, GS staged one its trademark "I STUBBORNLY refuse to die" rallies, on volume.

It looked to have closed at 142.75, but they suddenly knocked it down in the final tick, to 142.15. I don't know what that was, but I can promise you that The Bears won't be saying anything about "market manipulation" to describe tha-a-at nice little drop! LOL. Kidding aside, some of these late day rallies in Goldman do look a tad suspicious, eh? That's alright. We'll "play it as it lies."

Goldman still is trading within the Rising Wedge. I've put the data points for the trendlines on the chart. Speaking of suspicious...

...the MACD has me suspicious about another rally attempt in Goldman, toward the top of the Rising Wedge. It has failed twice at its signal line (the last two red arrows) but as the MACD itself moved lower, to Green #2, the Histogram below (vertical black lines) at the corresponding Green #2 flattened out, showing a positive divergence.

The MACD continued down to a "lower low," yesterday, at Green #3, but the Histogram at the corresponding Green #3 higher, showing an even stronger positive divergence than at Green Data Points #2. While we never allow indicators to TELL US what to do, the MACD is "indicating to us" that there now are TWO positive divergences in the Histogram, and it's up to us to decide whether or not we want to do anything about that.

For example, Goldman is down three days in a row, but The Bears haven't quite been able to challenge the bottom of the Rising Wedge, so the stock hasn't done anything wrong yet. If we should see Goldman go down there and tag the bottom of the Rising Wedge, or come close to it (including a nominal violation to the downside), then rally back to UNCH...then go green...then take out yesterday's high of 143.31...

...those moves would suggest "Be careful, now!"

Gain: $200

7 comments:

At 7:27AM, Bernstein upgraded Goldman to outperform, with a price target of $176. They raised '09 EPS to $15.33 and '10 EPS to $16.47.

Goldman is indicated to gap up about $2.00, currently at BID: 144.00 ... ASK: 144.15.

Now, let's not accuse anyone in Wall Street of being crooked, or anything like that. I'm feel quite sure that all of those folks who bought the late afternoon rally in Goldman are totally honest people who "didn't know nuthin'" about this upgrade coming out this morning. Wink. Wink.

If you are suggesting that WS salesmen leak info to their best clients, I am shocked at your attitude. Wall St. is a totally honest place to work.

On another note, I was hoping you had played XING as it worked beautifully. I had been watching but when the BO happened I was otherwise engaged and missed the entry. You did as well. Here is my question: should I perhaps have put in a buy stop order at say $2.25 while I was doing something else.I notice you don't use that order type. Any comments on order entry on this type of BO would be helpful. Thanks again

Mark

Good Morning, Mark,

LOL on your Wall St. comment.

I bought XING three weeks ago and still am long. I make a lot of trades that I don't post because I don't want the burden of feeling obligated to explain them, follow up on them, post when I close trades out, etc. I'm not interested in running a trading service, especially a free one ;)

I've never used Buy Stop orders, but that would have been fine to put in an order on XING if you had wanted to do that.

I see the target of GS to about 152 the top of the wedge, maybe even a fake out. I am absolutely shocked at your suggestion; making a statement like that to your favored clients would be illegal and unethical, something people on Wall Street and particularly the MM would never even consider. I am sure these were all just retail J6pk who did their outstanding TA and bought based on that as they usually do with complete success and profit.

IC,

Thanks for your input. Goldman currently is up over $7.00 and is above the top of the Wedge by about ten cents.

Hey, now I didn't suggest anything! All I said was that I thought that all of the people who bought Goldman late yesterday afternoon were totally honest people who "didn't know nuthin'" about this morning's upgrade.

I don't know why my eye twitched.

"Wink. Wink." Must be part of old age ;)

that looked like a successful test of the overhead resistance of GS' bearish rising wedge to me...

would you agree with that melf?

Good Morning, Kevin,

The close is a technical breakout of the Rising Wedge. I'll elaborate on that further in this morning's post.

Post a Comment