We got a late afternoon pop out this bullish continuation pattern, a Bull Flag, as the general market was tanking. The breakout puts a target of about 12.45 IN PLAY, reinforcing the 12.63 and 12.94 targets that already are IN PLAY.

Friday, January 30, 2009

SLV - Third Bullish Breakout - Bull Flag

We got a late afternoon pop out this bullish continuation pattern, a Bull Flag, as the general market was tanking. The breakout puts a target of about 12.45 IN PLAY, reinforcing the 12.63 and 12.94 targets that already are IN PLAY.

Wednesday, January 28, 2009

SPX: Bullish Inverse H&S

Since completing the Bearish Wolfe Wave, at Wave#6, and since breaking below the bottom of the late December Ascending Triangle on January 14 (the near-horizontal yellow line), the SPX has been basing, and has formed a Bullish Inverse H&S pattern.

The SPX futures currently are up 17 points, so if that holds up we'll have a Breakaway Gap out of the pattern which will put a target of roughly SPX 900 IN PLAY. Targets against the dominant trend, which is bearish, are less likely to be achieved, so keep that in mind and "take profits when targets get MADE."

As long as the SPX trades above the neckline, the first target is 857.07-858.13, the December 29 low and the January 16 high, respectively. 858.13 is the first data point of the neckline of the Bullish Inverse H&S pattern.

The next target is the bottom of the broken Ascending Triangle (the near-horizontal yellow trendline), which comes in today on the daily chart at 868.51. The 50DMA currently is 868.388, and declining, so it's very near that trendline.

Sunday, January 25, 2009

XOM, GLD & IBM

Bearish Rising Wedges often morph into a H&S Top, or some other bearish pattern. In this case, the latter would be the Symmetrical Triangle (in red). The bottom of that pattern is a validated trendline. XOM had a good bounce off that on January 15, so unless/until that gets broken to the downside, the chart is Neutral.

The GLD was an upside surprise this week. After breaking below a Bear Flag and CLOSING below the channel, it ripped to the upside and closed at a new high for the move. Fortunately, the Bullish SLV chart (posted last weekend, and again yesterday) kept me from shorting the GLD.

The case for a Bullish Inverse H&S in IBM primarily is supported by:

1. The volume looks right. Highest in the Left Shoulder, next highest in The Head, lowest in the Right Shoulder.

2. The breakout was on thin volume, but on a retest, the neckline held as support, within four cents.

3. The low of the Right Shoulder never was violated.

A good case can be made that the thinner green line is the neckline, which makes more sense from the standpoint that volume came in on the breakout above that.

IBM needs to get to at least $106-ish to support the Inverse H&S thesis.

Saturday, January 24, 2009

SLV - Double Breakout

Wednesday, January 21, 2009

SPX - Inaugural Smackdown

Monday, January 19, 2009

SLV: Successful Retest

The SLV chart has me thinking that the Channel breakdown in the GLD (see last post) might have been a Breakdown Fakeout. The SLV had a Symmetrical Triangle breakout, appeared to have put in a possible Double Top, but successfully retested the Symmetrical Triangle last week, and now is poised to break out of this Ascending Triangle.

This chart is bullish. I likely will buy an Ascending Triangle breakout, or a fill of Friday's gap.

Saturday, January 17, 2009

GLD: At Bear Flag Resistance

Pattern Review:

Symmetrical Triangle (Pattern in Black)

1. On November 21 when the rest of the market was printing new lows, the GLD had a Breakaway Gap, putting a measured move target of 85.39 IN PLAY, but the pattern was skimpy in terms of width, and the GLD had to rally into nearby resistance. Breakouts and breakdowns often get retested. Those two factors suggested that this one would be coming back.

2. The retest was a knuckle-biter for anyone who was long when the GLD went well below the top of the Symmetrical Triangle breakout intraday, on December 5. The "logical stop" for the trade was 72.00, the "last low" prior to the breakout. That held, and the GLD rallied into the close and stuck it at the top of the Symmetrical Triangle on a Bullish Hammer.

3. When the GLD came roaring back into the close, that was a very, very nice low-risk entry, using the 72.00 stop.

Rising Channel - (pattern in green)

1. Oh, buddy, look st the rally that ensued from that December 5 shakeout low! Where would we expect the rally to go?

a. We KNOW that we still have 85.39 IN PLAY from the Symmetrical Triangle.

b. We KNOW where the top of the channel is on the rally.

c. The 85.39 target MADE. The Top of the Channel target MADE.

2. The Top of the Channel target MADE on a Bearish Inverted Hangman, at the 200DMA, which was Bearishly Inverted with the 50DMA. That turned out to be a Fakeout Breakout, suggesting a return to the bottom of the channel.

Bear Flag (pattern in red)

1. From the Fakeout/Breakout high, the GLD traded sideways with a slight upward bias, in a Bear Flag.

2. January 5 was a gap down from 86.23. The low of that candle was 85.84. The January 6 high was a partial gap fill. The high was 85.70, so we've still got a little unfilled gap from 85.70-85.85. It's 85.70-86.23 if we include the gap down from the close, but a print of 85.84, technically, would fill that gap in the daily chart. We won't be picky ;)

3. The little candle circled in red was a "sell pivot" candle, based on the 13/21 RSI being at Bearish Synchronicity, and the 83.75 low of that candle getting taken down in the next session, so a print of 83.74 based on that "early warning" indicator was a SELL, on January 9.

4. January 10 was a Breakaway Gap to the downside, breaking the Bear Flag, and putting a measured move target of 76.91 IN PLAY (leave a comment and ask, if you don't know how to measure that), leaving another gap on the chart from 83.09. Notice that's only six cents away from the downside target of 76.91 is a gap at 76.85. Gaps don't always get filled, but given the target, that gap sure looks like a magnet.

5. January 14, the GLD returned to, and broke, the bottom of the channel, which was suggested by the December 17 upside Breakout Fakeout. Shorting that break, or shorting the retest of the broken channel on January 15 certainly is defensible, but we had TWO unfilled gaps on the way down, and the broken Bear Flag never was retested.

6. The January 16 gap up open STRONGLY suggeted at least a retest of the broken Bear Flag, and possibly a fill of those gaps. The bottom of the Bear Flag came in at 82.6922. The close was 82.71, just about smack on the bottom of the Bear Flag.

Summary: (geez, this is long-g. Sorry)

What do we KNOW? Not "know the future," because we can't. What do we know, as of the last candle's information? We know that the GLD has made three bearish moves:

1. The December 17 "Breakout Fakeout."

2. The Broken Bear Flag

3. The Broken Channel

We also KNOW that a target of 76.91 went IN PLAY on the Bear Flag breakdown. It goes ON HOLD if the GLD moves above the bottom of the Bear Flag, which it could do, to fill those gaps. It goes back IN PLAY if the GLD goes back below the flag.

We KNOW that the December 5 candle was a HUGE downside fakeout/shakeout that filled a gap, then closed on a Bullish Hammer, so on a rally here, we want to watch those gaps above. Those gaps were what kept me from shorting Friday's close AT former support (the bottom of the flag), which "should be" resistance. Another factor that kept me from shorting Friday's close is the obvious fact that the January 14 Channel breakdown possibly was a Fakeout/Breakdown, just as the December 17 candle was a Fakeout/Breakout.

I'm going to watch for an immediate sign of failure right here, or a rally to fill the gaps, that fails.

Goldman: Perfect Entry - Imperfect Play

I had a perfect entry into that trade, which is the primary reason that I made the $1,300 in about an hour. I don't mean that as patting myself on the back, but rather, that my 17.94 entry at the retest of the broken neckline is where we have an excellent chance of a successful trade, technically.

The idea is similar to getting your money "all in" with the best hand in Texas Hold 'Em poker. We'll win more of those than we lose. Only in the stock market, PLEASE don't go "all in." This isn't Texas Hold 'Em. LOL.

"Former support 'should be' resistance on a retest," and as we could see from this chart that I posted on January 14, it was. Morgan never went any higher than that, and down she went. One of the reasons that I grabbed the dough so quickly was that the market was very oversold and coming into a support area. Another reason that I cashed it in was that I didn't want to sit through a possible fill of the gap in the chart from just before the neckline breakdown, which frequently occurs. In this case though, there was no problem on the short trade whatsoever.

In retrospect, selling half quickly and holding the remaining half for the target IN PLAY would have been a very nice way to trade it. "Coulda...shoulda...woulda." LOL.

Eyeballing the intraday chart (hard to measure exactly), The H&S Top target was "roughly" 14.90, On the daily chart, I came up with 14.77. Both MADE on Friday as Goldman fell to the low 14's, then bounced. Targets aren't exact anyway. It's "what we're aiming for" based on what the pattern measurement suggests.

In addition to reviewing the pattern and the play of the trade, I've presented this in preparation for my post on the GLD, which also has had TWO "perfect entries" on retests of broken support, one of which has proven to be much more difficult than this one in Goldman. The outcome of the other "perfect entry," which was to short Friday's close, remains to be seen. We'll look at the GLD in my next entry this weekend.

Friday, January 16, 2009

NASDAQ 1600 - Double Resistance

When we last looked at the 89/144 RSIs at the first red arrow at the beginning of the year, we knew that they were at Bearish Synchronicity. On January 6, we got the Bearish Wolfe Wave 5 Fakeout Breakout, ultimately a TRIPLE refusal in these RSI's, and down we went. 1478 "last support" was violated, but it held on a CLOSING basis on January 14, and look where we ended up yesterday!

The NASDAQ closed just eleven cents below the bottom of the smaller Ascending Triangle (in purple). Look at the similarity between the last two candles on the chart, and the two candles of the November 20-21 Bear Trap. Yesterday's candle wasn't quite as good as the November 21 candle, but it's a Bullish Hammer and if the NASDAQ can rally back inside the Ascending Triangle, it sets up another Bear Trap, and a chance for a rally back to key NASDAQ 1600 area, which is where the big Ascending Triangle (in green) broke out.

If we should get to the 1600 area between now and the time that we become Obamanation, it not only is the top of the big Ascending Triangle in the last chart, it also where the bottom of the broken Bearish Rising Wedge comes in for the next couple of trading sessions, so it's DOUBLE RESISTANCE. The Bulls have to get through that level AGAIN. The Bears very much want to defend that level this time, and not allow The Barbarian through the gate.

The 55/89 RSIs came back to Bullish Synchronicity and bounced higher yesterday, so that's good to go for a rally.

If we rally to 1600, the MACD will move higher, back toward its declining signal line. That kind of move is a "Feet, don't fail me now!" because if the MACD fails at/near the signal line, that's a Kiss of Death signal that sometimes results in a sizeable move to the downside, like the one we got off the September Kiss of Death signal.

Thursday, January 15, 2009

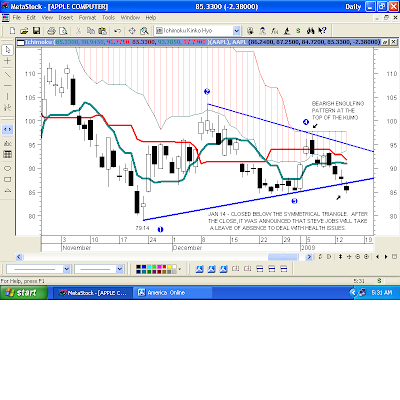

AAPL: First The Chart...Then The News

Sometimes, bad news comes out on a stock without any warning in the chart.

Shareholders simply get blind-sided, and take a hit.

At other times though, like this, if shareholders are paying attention to the chart and sell the break of pattern support ("First the chart..."), they get rewarded later on when "a reason" is given for the breakdown ("...then the news").

"Sell and/or sell short breaks of technical support."

Sadly, "the bad news" is about Steve Jobs' health. My best wishes to him.

Shareholders simply get blind-sided, and take a hit.

At other times though, like this, if shareholders are paying attention to the chart and sell the break of pattern support ("First the chart..."), they get rewarded later on when "a reason" is given for the breakdown ("...then the news").

"Sell and/or sell short breaks of technical support."

Sadly, "the bad news" is about Steve Jobs' health. My best wishes to him.

Wednesday, January 14, 2009

Morgan Stanley: H&S Top

Morgan Stanley broke the neckline of a H&S Top in the early going this morning.

"Sell and/or sell short breaks of support. Also, sell and/or sell short retests of broken support."

After the breakdown, Morgan rallied back for a retest of the broken neckline where I entered my order to short it at 17.94, just below the breakdown. Scottrade finally let me short something, which I feel I deserve after they refused THREE times to allow me to short the TRIPLE H&S Top in Goldman last week! LOL. Made a little better than $1,300 on the trade.

SPX & NASDAQ - Post-Breakouts

Since the DOUBLE Breakout on January 2, of both the Ascending Triangle (purple) and the Channel (blue), the SPX has been giving indications that it was a false breakout. It has closed back below both patterns, and back below the 20/50DMA's.

In yesterday's trading, the SPX violated the bottom of the Ascending Triangle for only ONE MINUTE, at 2:26PM, then it rallied into the close, but it needs to get going to the upside after all of these signs of breakout failure. Yesterday, the MACD crossed below its signal line, indicating that this could roll over and die if it can't re-establish some momentum to the upside.

Just like the chart of Goldman Sachs, the NASDAQ has broken the Ascending Line of the DOUBLE Ascending Triangle, suggesting that those patterns morphed into a Bearish Rising Wedge (pattern in black), which has broken down. The market doesn't always confirm a breakout or breakdown, but if the NASDAQ rallies to the broken trendline, then fails, that would be confirmation.

In yesterday's trading, the SPX violated the bottom of the Ascending Triangle for only ONE MINUTE, at 2:26PM, then it rallied into the close, but it needs to get going to the upside after all of these signs of breakout failure. Yesterday, the MACD crossed below its signal line, indicating that this could roll over and die if it can't re-establish some momentum to the upside.

Just like the chart of Goldman Sachs, the NASDAQ has broken the Ascending Line of the DOUBLE Ascending Triangle, suggesting that those patterns morphed into a Bearish Rising Wedge (pattern in black), which has broken down. The market doesn't always confirm a breakout or breakdown, but if the NASDAQ rallies to the broken trendline, then fails, that would be confirmation.

Monday, January 12, 2009

Goldman: TRIPLE H&S Top

From yesterday:

"I really, really don't like Friday's close below the validated trendline, AND close below what sure looks to be a morph into a Bearish Rising Wedge."

Apparently, The Market really, really didn't like that either. LOL.

In addition to the two H&S Tops that we got last week, we got a third one that that has broken down.

"I really, really don't like Friday's close below the validated trendline, AND close below what sure looks to be a morph into a Bearish Rising Wedge."

Apparently, The Market really, really didn't like that either. LOL.

In addition to the two H&S Tops that we got last week, we got a third one that that has broken down.

Sunday, January 11, 2009

Goldman & Morgan Stanley: The Olde Guards

As you probably can tell, I'm very picky and demanding about patterns and trendlines, etc. Rarely will I award a chart a "Perfect 10," but for their performance from their respective lows into the end of December, my scores for Technical Merit for both Goldman and Morgan were:

10...10...10...10...10...10...10...

The patterns and the pattern consolidations were very, very good:

1. They formed "patterns within pattern."

2. Some of the breakouts/trendlines got successfully retested, validating a breakout, or a trendline.

a. See the purple "Thumbs Up" on the Morgan Stanley chart (#3), on December 12.

b. See the purple "Thumbs Up" on the Goldman chart, on December 26/29

c.

3. They gave technical BUY signals on horrible earnings. Stocks that miss by a few pennies often get taken out and shot. Morgan missed by two DOLLARS, nearly 600% worse than the estimate. It not only didn't crash, it rallied and it broke out of a Bullish Inverse H&S pattern (see the last chart, below).

4. They temporized into the end of December, giving the 20/50DMA's a chance to play catch up, and eventually make Bullish Crosses.

5. They both had TRIPLE Bullish pattern breakouts.

Off its December low, Goldman has rallied 93%; off its October low, Morgan has rallied 198%. Whew!

Where I had to start giving point deductions was after the breakouts, both of which occurred on thin volume in holiday trading. I didn't deduct for that, but once we got into post-holiday trading, neither chart any longer was a "Perfect 10," in my view.

The lack of volume was one of the main reasons that I watched for any "foot faults" in Goldman early last week, which is how I caught both H&S Tops in the intraday charts, and which is why I wanted to short it. Both were H&S Tops with "nested patterns, " which I very much liked for a short play back to breakout support. No shares were available to short, but both downside targets got MADE (see those charts posted last week).

Ascending Triangles are notorious for morphing into Bearish Rising Wedges/Bearish Channels, particularly in a bear market. We'll examine what that looks like next.

Uh-oh. We got problems, Houston!

1. Ascending Triangle: On a retest, the top of the Ascending Triangle, at 81.19-81.29 "should be" support. On Friday, Goldman went below it, to 80.42, but it rallied off that in a down market, so that isn't much of a point deduction. Those minor violations often occur, and it ends up not being a problem. Not too bad.

2. The Rising Trendline: That trendline was "validated support," meaning that it was tested, and held (the purple Thumbs Up on the first chart, on December 26-29). Once Goldman had the TRIPLE breakout, we want to see "Go...Go...Go" to the upside, not a BREAK of that validated trendline. On Thursday, Goldman gapped down below, but quickly rallied. Well, okay, but I don't like that. Point deduction. On Friday, Goldman CLOSED below that validated trendline. Sorry, Goldman, but that's a BIG point deduction (I don't really use actual points...just having fun with that. LOL).

3. Bearish Rising Wedge: Does the pattern in blue look suspiciously like a Bearish Rising Wedge that got broken on a CLOSING basis? HUGE point deduction! LOL.

Summary on Goldman: As I said at the outset, I'm picky and demanding about patterns, trendlines, etc. and I really, really don't like Friday's close below the validated trendline, AND close below what sure looks to be a morph into a Bearish Rising Wedge. I wanted Goldman long if it could hold above the 82.19-82.29 Ascending Triangle breakout on a CLOSING basis, and it has done that so far, but I'm going to pass on that idea. In fact, I'm downgrading Goldman's scores for Technical Merit:

6...5...5...4...5...6...2

Judge #7 is extremely annoyed about the lack of volume on the TRIPLE breakout. LOL.

This post is much too long. The patterns should be self-explanatory (ask if they are not), so just a couple of comments on Morgan Stanley:

1. The volume in the Inverse H&S Bottom (pattern in blue) was near-perfect textbook: highest in the left shoulder, next highest in the head, lowest in the right shoulder, indicating a diminution of selling interest, then a breakout above the volume trendline on the pattern breakout. That looked fine. But, look at the volume on the TRIPLE Bullish Breakout (pattern in black) on January 2, and the volume thereafter. YUK.

2. Morgan looks much better than Goldman because it hasn't broken any trendlines, nor has it broken back below any patterns, but if it breaks Thursday's low of 17.65, that puts in a short-term Double Top (19.93 and 19.98 highs), which would put a target of 15.37 IN PLAY as long as Morgan trades below the pattern breakdown, below 17.65.

Thursday, January 8, 2009

GS - Rising Channel - Another H&S Top

Similar to yesterday, Goldman put in another H&S Top. This one began with a Rising Channel (in white) that morphed into the H&S Top (in yellow). Notice how the high of the Right Shoulder of the H&S Top also was a failed retest (confirmation) of the broken channel (arrow).

Nested patterns and failed retests (confimations) tend to increase the chances of success in getting to the target. The breakdown put 84.12 IN PLAY, which MADE.

Wednesday, January 7, 2009

SSO: Bearish Wolfe Wave - GS: H&S Top

Tuesday morning's rally to SPX 944 was a Bearish Wolfe Wave 5 "Fakeout/Breakout." Notice how the afternoon retest of the high failed below the top of the pattern (sometimes they make a nominal new high, then fail). This morning's open was a gap down below the Wolfe Wave pattern, and down she went. The SSO almost got to the Wave 6 target line this afternoon.

Goldman gapped down below a H&S Top that contained a nested Descending Triangle (pattern in yellow) in the Head. Nested patterns (patterns within patterns) seem to give an added degree of reliability to the eventual outcome.

I tried to short it at 87.80, the 50% retracement of this morning's gap, but my broker had no shares available to short. Curses! The target was roughly 84.00, which got MADE. The low on the day was 83.65.

Math for the target:

92.20 - High of the pattern

88.10 - Average of the 88.15 and 88.05 neckline data points

92.20 - 88.10 = 4.10 points of downside. 88.10 - 4.10 = 84.00 IN PLAY

Blogger is having an "internal error" problem so I can't upload the charts. I'll try again in the morning. I'm having a frustrating day. LOL.

EDIT: Here's the Bearish Wolfe Wave in the QLD. The target got MADE almost exactly.

GIGM: Three Targets

From December 21:

"GIGM certainly got overbought on that rally, and it put in a Bearish Engulfing pattern on December 18. The 20/50DMA's also are inverted, so the stock is "ahead of itself," but on a selloff, it's got some support below it, i.e, the moving averages and the top of the Bullish Wolfe Wave."

December 21 Chart:

GIGM moved sideways-to-down, with identical lows at 5.25, which gave the 20/50 DMAs a chance to make a Bullish Cross. The pattern in purple is a Descending Triangle, which more often than not, is considered to be a bearish pattern. A breakout near the apex of a triangle also is considered to be bearish, with the expectation that it will resolve to the downside. Two examples of how there is no "ALWAYS" in the stock market, eh?

GIGM was anything but bearish. It rallied out of the Descending Triangle, and three targets got MADE yesterday: 6.69, 6.82 and 7.00. At yesterday's high of 7.10, GIGM was up 169% off its November 21 low. "Take at least 'some' profits when targets get MADE."

The Bullish Wolfe Wave target is way-y up there. Those target lines usually look very unrealistic, but it will be fun to watch it, to see if it gets MADE.

"GIGM certainly got overbought on that rally, and it put in a Bearish Engulfing pattern on December 18. The 20/50DMA's also are inverted, so the stock is "ahead of itself," but on a selloff, it's got some support below it, i.e, the moving averages and the top of the Bullish Wolfe Wave."

December 21 Chart:

GIGM moved sideways-to-down, with identical lows at 5.25, which gave the 20/50 DMAs a chance to make a Bullish Cross. The pattern in purple is a Descending Triangle, which more often than not, is considered to be a bearish pattern. A breakout near the apex of a triangle also is considered to be bearish, with the expectation that it will resolve to the downside. Two examples of how there is no "ALWAYS" in the stock market, eh?

GIGM was anything but bearish. It rallied out of the Descending Triangle, and three targets got MADE yesterday: 6.69, 6.82 and 7.00. At yesterday's high of 7.10, GIGM was up 169% off its November 21 low. "Take at least 'some' profits when targets get MADE."

The Bullish Wolfe Wave target is way-y up there. Those target lines usually look very unrealistic, but it will be fun to watch it, to see if it gets MADE.

Tuesday, January 6, 2009

NASDAQ & SPX: Just A Random Walk

In the cash SPX, we knew that the highs of the December 8-January 2 Ascending Triangle were 918.57 and 918.85, respectively. The slight upward slope of that trendline is +0.04, so it came in yesterday at 919.29. Yesterday's low was 919.53 at 9:55AM,, just 0.24 above former resistance, then the market moved higher. That probably was purely coincidental.

In the NASDAQ, the Ascending Triangle breakout was 1603. At 9:55 AM yesterday morning, the NASDAQ put in a low at 1604.83, then that index rallied, too! I don't know about anyone else, but that convinces me that markets are completely random and that no one was really looking at a chart and buying because former resistance was acting as support after a TRIPLE breakout. Nah-h-h...

No, markets don't always behave with that kind of exactitude, and yes, markets do behave randomly at times. Probably most of the time. But, if we can identify those times when the market ISN'T behaving randomly, through whatever tools that we have at our disposal, it's to our advantage.

Both the SPX and NASDAQ had Bullish Crosses of their 20 & 50 DMAs yesterday for the first time since September 15, so on any selloff to the MAs, those are areas to look for support. Below the MAs, next support would be the rising trendlines of the Ascending Triangles. Below the rising trendlines, I'd have a hard time being convinced that there's anything bullish about these charts.

SPX:

20 DMA - 889.23

50 DMA - 887.41

NASDAQ:

20DMA - 1552.20

50DMA - 1550.58

In the NASDAQ, the Ascending Triangle breakout was 1603. At 9:55 AM yesterday morning, the NASDAQ put in a low at 1604.83, then that index rallied, too! I don't know about anyone else, but that convinces me that markets are completely random and that no one was really looking at a chart and buying because former resistance was acting as support after a TRIPLE breakout. Nah-h-h...

No, markets don't always behave with that kind of exactitude, and yes, markets do behave randomly at times. Probably most of the time. But, if we can identify those times when the market ISN'T behaving randomly, through whatever tools that we have at our disposal, it's to our advantage.

Both the SPX and NASDAQ had Bullish Crosses of their 20 & 50 DMAs yesterday for the first time since September 15, so on any selloff to the MAs, those are areas to look for support. Below the MAs, next support would be the rising trendlines of the Ascending Triangles. Below the rising trendlines, I'd have a hard time being convinced that there's anything bullish about these charts.

SPX:

20 DMA - 889.23

50 DMA - 887.41

NASDAQ:

20DMA - 1552.20

50DMA - 1550.58

Sunday, January 4, 2009

NASDAQ: Triple Breakout

From January 1 post:

"The Bulls still need to knock out 1603."

The smaller Ascending Triangle (in purple) broke out on Friday morning at 1590; the larger Ascending Triangle (in green) broke on Friday morning as well, crossing 1603, so combined with the breakout of the Bullish Falling Wedge (in blue) on December 16, the NASDAQ has broken out of three patterns to the upside. The upside targets are listed on the chart.

A word about targets: they only are what the pattern measurements off the breakouts "suggest" that a stock or index is aiming for, and by no means are any sort of guarantee. But, unless/until the breakouts get reversed to the downside (a CLOSE below the breakouts), the targets are IN PLAY.

The 55/89 RSIs did a fine job of leading price by breaking out of their respective Ascending Triangles on December 16. During the year-end pattern consolidation while the NASDAQ was searching for "Data Point #4," (see my prior post on that subject), which concluded with the Ascending Triangle (in purple), the 55/89 RSIs went into Bullish Synchronicity TWICE. As I mentioned in a prior post, that kind of compression at synchronicity can result in a nice move, once the energy is released. The NASDAQ finally put in the Data Point #4 low that we were looking for, at 1493 on December 29, then it rallied just under 150 points.

Moving down in the Fibonacci sequence, the 89/144 RSIs also have broken out above their respective Ascending Triangles, but they're currently at Bearish Synchronicity, meaning that their readings are very close, and that they're inverted, with the 89 RSI still positioned below the 144 RSI.

If the NASDAQ should reverse here at Bearish Synchronicity and take out the 1478 and 1493 lows of the purple Ascending Triangle on a CLOSING BASIS, that certainly would give a very strong suggestion that this Triple Breakout was a fakeout. Volume was weak on Friday's breakout, but we'll next look at an example in which weak volume ultimately didn't matter very much as far as getting a very tradeable rally was concerned.

On April 1, the QLD had an upside gap and a breakout out of a Bullish Inverse H&S (in blue). Look at the volume on the breakout (first blue arrow on the volume chart). Horrible. The QLD rallied for a few days, establishing the neckline of a larger Bullish Inverse H&S (in purple), then it had a rather wicked decline, back to fill the April 1 gap.

Notice that the low of the Right Shoulder did NOT get violated on that selloff, and that the selloff gave everyone a chance to get "beared up," which is the purpose of a good Bear Trap. The QLD gapped away again, and then gapped out of the "nested" Bullish Inverse H&S patterns on April 18. It went on to score a 33% gain over the next 6-7 weeks off the 69.63 Bear Trap low.

Look at the volume on the second breakout (second blue arrow). Not horrible, but pretty lousy. And, look at the volume on the ensuing rally. Lousy. But, despite the lousy volume, the first Bullish Inv. H&S target of 86.94 got MADE with no problem, and roughly 85% of the 94.77 larger Bullish Inv. H&S target also got MADE.

The second target is a great example of how targets are "what we're aiming for," but that they don't always get MADE. There's no ALWAYS in the stock market, but that rally was a nice one, and there were lots of clues at the final high of 92.55 that the rally was in trouble, and plenty of chances to get out with a gain:

1. The DOUBLE negative divergence in the MACD.

2. The "Kiss of Death" in the MACD (failure from below the signal line).

3. The eventual break of the Rising Channel (in red).

4. The eventual break of the Double Top.

5. The failed retest of the broken channel.

6. Increased volume after the channel retest failure, etc.

"The Bulls still need to knock out 1603."

The smaller Ascending Triangle (in purple) broke out on Friday morning at 1590; the larger Ascending Triangle (in green) broke on Friday morning as well, crossing 1603, so combined with the breakout of the Bullish Falling Wedge (in blue) on December 16, the NASDAQ has broken out of three patterns to the upside. The upside targets are listed on the chart.

A word about targets: they only are what the pattern measurements off the breakouts "suggest" that a stock or index is aiming for, and by no means are any sort of guarantee. But, unless/until the breakouts get reversed to the downside (a CLOSE below the breakouts), the targets are IN PLAY.

The 55/89 RSIs did a fine job of leading price by breaking out of their respective Ascending Triangles on December 16. During the year-end pattern consolidation while the NASDAQ was searching for "Data Point #4," (see my prior post on that subject), which concluded with the Ascending Triangle (in purple), the 55/89 RSIs went into Bullish Synchronicity TWICE. As I mentioned in a prior post, that kind of compression at synchronicity can result in a nice move, once the energy is released. The NASDAQ finally put in the Data Point #4 low that we were looking for, at 1493 on December 29, then it rallied just under 150 points.

Moving down in the Fibonacci sequence, the 89/144 RSIs also have broken out above their respective Ascending Triangles, but they're currently at Bearish Synchronicity, meaning that their readings are very close, and that they're inverted, with the 89 RSI still positioned below the 144 RSI.

If the NASDAQ should reverse here at Bearish Synchronicity and take out the 1478 and 1493 lows of the purple Ascending Triangle on a CLOSING BASIS, that certainly would give a very strong suggestion that this Triple Breakout was a fakeout. Volume was weak on Friday's breakout, but we'll next look at an example in which weak volume ultimately didn't matter very much as far as getting a very tradeable rally was concerned.

On April 1, the QLD had an upside gap and a breakout out of a Bullish Inverse H&S (in blue). Look at the volume on the breakout (first blue arrow on the volume chart). Horrible. The QLD rallied for a few days, establishing the neckline of a larger Bullish Inverse H&S (in purple), then it had a rather wicked decline, back to fill the April 1 gap.

Notice that the low of the Right Shoulder did NOT get violated on that selloff, and that the selloff gave everyone a chance to get "beared up," which is the purpose of a good Bear Trap. The QLD gapped away again, and then gapped out of the "nested" Bullish Inverse H&S patterns on April 18. It went on to score a 33% gain over the next 6-7 weeks off the 69.63 Bear Trap low.

Look at the volume on the second breakout (second blue arrow). Not horrible, but pretty lousy. And, look at the volume on the ensuing rally. Lousy. But, despite the lousy volume, the first Bullish Inv. H&S target of 86.94 got MADE with no problem, and roughly 85% of the 94.77 larger Bullish Inv. H&S target also got MADE.

The second target is a great example of how targets are "what we're aiming for," but that they don't always get MADE. There's no ALWAYS in the stock market, but that rally was a nice one, and there were lots of clues at the final high of 92.55 that the rally was in trouble, and plenty of chances to get out with a gain:

1. The DOUBLE negative divergence in the MACD.

2. The "Kiss of Death" in the MACD (failure from below the signal line).

3. The eventual break of the Rising Channel (in red).

4. The eventual break of the Double Top.

5. The failed retest of the broken channel.

6. Increased volume after the channel retest failure, etc.

Thursday, January 1, 2009

NASDAQ: Knock! Knock!

The NASDAQ finished out the year knocking on the door of an upside technical breakout of the Double Ascending Triangles, or a Cup And Handle, if you will. The Bulls still need to knock out 1603. If they can, the 1679 gap from November 5, where the Bulls failed on the November 10 "Gap To Crap," would be a minimum rally expectation.

We can see in the Ichimoku Kinko Hyo chart ("At A Glance...The Table of Balance") that the Bulls have penetrated the Kumo (Cloud) resistance, represented by the vertical red lines. The top of the Kumo (Cloud) currently is 1689, so 1679-1689 looks to be on tap if the Bulls can break out of the patterns.

Recall that the 55/89 RSIs that we've been watching both already had broken out of their own Ascending Triangles, on December 16. They're leading price, which hasn't broken out yet. Those RSI's came into Bullish Synchronicity twice after their Ascending Triangle breakouts, indicating internal strength, which resulted in the biggest 2-day year end gain in over half a century. They've bounced higher on the rally and still are good to go, if price wants to cooperate.

We can see in the Ichimoku Kinko Hyo chart ("At A Glance...The Table of Balance") that the Bulls have penetrated the Kumo (Cloud) resistance, represented by the vertical red lines. The top of the Kumo (Cloud) currently is 1689, so 1679-1689 looks to be on tap if the Bulls can break out of the patterns.

Recall that the 55/89 RSIs that we've been watching both already had broken out of their own Ascending Triangles, on December 16. They're leading price, which hasn't broken out yet. Those RSI's came into Bullish Synchronicity twice after their Ascending Triangle breakouts, indicating internal strength, which resulted in the biggest 2-day year end gain in over half a century. They've bounced higher on the rally and still are good to go, if price wants to cooperate.

Subscribe to:

Posts (Atom)