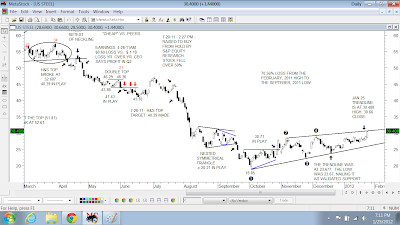

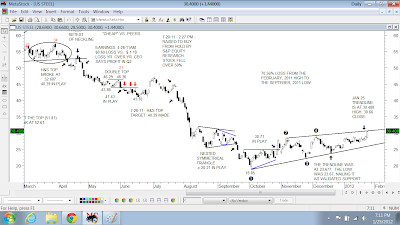

The December 19

validation of support at the bottom of the Rising Wedge earned US Steel (X) a rally back to the top of it yesterday, and in the process, the October 27 Ascending Triangle target of 30.71 got MADE, within five cents. The session high was 30.66.

From yesterday morning on AKS:

"The early selloff accomplished two things: (1) it filled most of the gap left in the chart from January 9, and (2)

it estabished White Data #4 for yet another possible bullish pattern, a Bull Flag (the pattern in white), which is the pattern in purple in the next (daily) chart."Yesterday, on the strength of the three pattern breakouts that preceded it, AKS had a FOURTH upside technical breakout to a recovery high of 10.12, so the bullishness of the nearly six month basing period and recent breakouts is being borne out.

The Bull Flag (pattern in purple) broke out yesterday crossing 9.33, so the upside targets are: a retest of the 9.96 pattern high (that got MADE yesterday), and 10.53, which is the measured move off the breakout.

9.96 - pattern high

8.76 - the release of earnings Fakeout/Bear Trap low

9.96 - 8.76 = 1.20 points on the breakout above 9.33, which is where purple trendline #1-#3 was yesterday when the stock broke out.

9.33 (breakout point) + 1.20 points = Target: 10.53 IN PLAY

That target just is what this particular pattern suggests. The pattern doesn't "know" what the chart looks like, so it must viewed in context of the entire chart. We can see that there is no nearby overhead resistance, so the stock has a bit of open field running between here and the target(s). Shareholders who held the stock during the autumn Smackdown and who didn't throw in their shares during year-end tax loss selling have a very good chance of recovering some losses and aren't as likely to sell as they were prior to the upside breakouts.

From yesterday morning on BIDU:

"What "could be" bullish in this chart, potentially, is that the takeout of the Inverse H&S pattern is a "Fakeout/Breakdown," and that The Bulls will reverse it and race back to that critical breakdown at

123.50, which coincidentally also is where the top of the Falling Wedge came in yesterday."

Yesterday's action in BIDU is exactly the type of thing that I was looking for when I bought it on Tuesday at 122.03 and ended up throwing it in for $1,000 loss.

Curses! Curses! CURSES!!!

The Bulls threw the long bomb into resistance on yesterday's opening play, but that usually doesn't work, and it didn't. The Bulls got sent back to retest the possible "Fakeout/Breakdown" low, and they held their ground. I liked that.

The successful retest set up the stampede for

123.50 resistance that I was looking for on Tuesday. The Bulls then took out the opening high and ran directly to

123.50 exactly, which proved daunting on that first attempt.

After a sizeable pullback to the Exponential Moving Averages (EMAs), which provided support, The Bulls were baaa-ack, this time to

123.49.Another, more shallow, pullback and The Bulls were baaa-ack again, to

123.49. That's the hallmark of an Ascending Triangle: Flat top; increasingly shallow pullbacks.

Geez, I hated "paying up" for the stock at 123.40 when I basically read it right when I bought if for 122.03 on Tuesday and took $1,000 loss, but let's try NOT to whine about "coulda...shoulda...woulda." There was enough evidence here that Tuesday's breakdown was a "Fakeout/Breakdown," so I "paid up" and bought 2,000 BIDU at 123.40. The Bulls had recovered to

123.50 and were building an Ascending Triangle pattern from which to launch a rally.

Game on!

There's the Ascending Triangle breakout, which put an upside target of 125.00 IN PLAY.

123.50 - high of the pattern

122.00 - low of the pattern

123.50 - 122.00 = 1.50 points of upside on a breakout

123.50 + 1.50 = Target: 125.00 IN PLAY

Note: Look at that Bull/Bear struggle right at

123.50 (horizontal red line) at the top of the Ascending Triangle, prior to the breakout. Some serious head banging, eh?!

Given how sloppy The BIDU Bulls have been, and given the VERY nearby resistance (yellow circle), I didn't stay for the 125.00 target. I sold my 2,000 shares for 124.45.

The 125.00 target ended up getting MADE. BIDU closed right near that at 125.05 after The Bulls scored a session high of 125.52.

Gain: $2,100