I found this stock early Wednesday morning when I was going over earnings. AMED reported great earnings on Tuesday and raised guidance for the year to $4.75 - $4.90, which based on Tuesday's close of $37.76 is a P/E ratio of only 8 basis the low end of guidance. In this economy, that looks pretty outstanding!

But, when I looked at the chart early Wednesday morning, I saw that it had gapped up to $41.75, but that it fizzled and closed at 39.00 on heavy volume. That didn't look good, but what did look good were the earnings AND the heavy short interest in the stock.

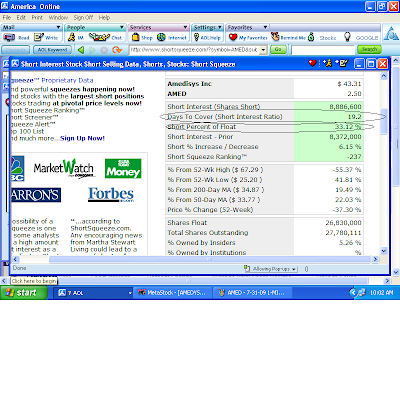

33% of the float is SHORT, which would take 19 days to cover, AND the stock had a bullish breakout of an Ascending Triangle on great earnings? Quit it!

Shorts should be severely punished for that and, of course, I don't mean that in a moral sense. I mean that it shouldn't get rewarded to be short a BULLISH breakout, especially not in a stock that is sporting a P/E ratio of only 8. Sheesh!

Despite the "fizzle" on Tuesday's reporting of earnings, I decided to watch it and buy the stock if it could take out Tuesday's high of 41.75. Sure enough on Wednesday, AMED printed a high of 42.20! When it pulled back from there, I bought it at 41.61 figuring that it should absolutely explode to the upside on a HUGE short squeeze (sorry, I didn't know that I'd be talking about this, so I didn't do a screen shot of my entry).

Well-ll, no short squeeze. AMED fizzled again, and closed Wednesday at 40.64 and I was under water by $1,000. Thursday, the stock did nothing, but closed up a little, at 40.81, so I was under water by $800. Gr-r-r...

Friday morning, AMED gapped up to 41.33, so I was almost whole. Volume trickled in and the stock went higher and took out Wednesday's high of 42.20, so I was in the green, but not happy with the volume and the 100 share trickles. I was looking for a PANIC to the upside and wasn't seeing it, so I sold the rally, not wanting to sit through another "fizzle." I was happy to have a nice gain after being under water on the trade for two days.

Fifteen minutes after I sold, an analyst came on CNBC, praising AMED! How it beat earnings. How it raised guidance...

I couldn't hear what else the analyst said, because I was thinking, "Somebody PLEASE kill me!" as it ripped higher, to 46.65. LOL.

Gain: $1,050

3 comments:

Thanks for describing a longer term trade than your usual 1-2 hrs. Sorry that you got panicky, makes you human.

Good Morning, Mark,

Sorry that you got the impression that I was panicked. Not at all. I was two days beyond earnings and not only didn't get the short squeeze that I was looking for, I got two fizzled rally attempts.

When I got the rally early Friday morning, it was a simple business decision to "take the money."

The analyst coming on CNBC touting the stock is one of those flukes for which there is no accounting. If he hadn't made the positive comments, the rally in AMED just as easily could have fizzled again.

Yes, a lot of my trades are 1-2 hours, or even less. I'm pretty much a trader. Sorry if you didn't realize that.

Post a Comment