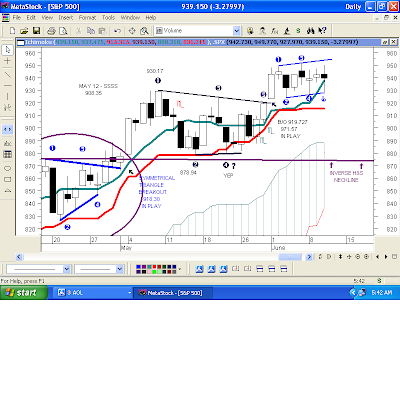

Bulls took it up at the open, Bears took it down for most of the session, then the Bulls brought it back into the bell, to just about smack in the middle of the recent trading range at the close. That seems rather fitting, since both teams have constructed short-term patterns, out of which they can break.

The Bears have a Bear Flag, in the chart above. The BIG arrow is the flagpole. The flag is "higher highs, and higher lows." Late afternoon, The Bears made a bid to take out the bottom of the flag, and break the pattern to the downside. Basis the daily chart, which we'll see below, that lower trendline came in yesterday at 928.167. The Bears took it down to 927.97, but the Bulls defended right at the trendline, validating it as support, then rallied it into the close.

When we're dealing with big numbers, like this index, we're talking hundredths and thousandths of a point. I like to put it into perspective. If the SPX were a $9.00 stock, the trendline would have been 9.2817. The low would have been 9.2797, for a difference of only 0.002. That's really close, and the fact that The Bulls were able to rally it as strongly as they did is further confirmation of that trendline validation.

If the Bears can take out that trendline, it "should have" some significance since it clearly has been validated as support. We know to be careful when validated support or validated resistance no longer IS support or resistance.

A takeout of that trendline would put roughly 27 points of downside IN PLAY, so roughly SPX 900, with the understanding that targets that are against the trend are less likely to get MADE. The trend is bullish.

The Bulls would argue that it isn't a Bear Flag at all, but rather, it's this Symmetrical Triangle. They intend to break it out and move higher, which would put the roughly 27 points IN PLAY on the upside. That would be roughly SPX 975-976, depending on the point of the breakout.

The Bears have been suffering since the March low, and would have to feel a good deal of relief if they can take out the validated trendline to the downside, with a target of roughly 900 IN PLAY.

On a breakdown, though, since the Bulls already have got 971.57 IN PLAY from the Symmetrical Triangle breakout on June 1 (pattern in black, seen in the next chart), and since the trend IS bullish, we would want to watch for a "morph" near SPX 920. That would accomplish three things:

A) It would fill the 920.02-923.26 gap (horizontal red line) left on the chart from the Breakaway Gap out of the Symmetical Triangle on June 1.

B) It would establish missing Yellow Data Point #4 of a BULL Flag (pattern in yellow)

C) It would trap existing Bears, who would be thinking that they were going to SPX 900, and it also would trap "newly minted" Bears, who would have shorted the break of the validated trendline.

On a breakdown, also watch for possible support at the top of the Symmetrical Triangle (pattern in black, seen in the next chart). That comes in today, June 11, at 914.157, and drops 0.6962 per session.

I've drawn the Bear Flag (pattern in blue) on this daily chart, but be aware that it "could be" a Symmetical Triangle, seen in the Chart #2 above.

As this chart stands, 971.57 still is IN PLAY from the Symmetrical Triangle Breakaway Gap on June 1. The current pattern is unresolved, with The Bulls and The Bears tied at the mid-range of the pattern, at yesterday's close.

The validated trendline (bottom of the pattern), basis the daily chart, comes in today, June 11, at 929.029. The slope of the trendline is 0.8631, so we add that amount each session.

8 comments:

Good morning melf

thanks for nice post.

Do you agree that dow has to finish

8200 by end of june(xtrend's point)?

Wow, I was going to ask you to review the SPX and here you are a step ahead as usual. As you can imagine, I have questions. The conflict between whether we are in a bear flag or symet. triangle I understand. What I don't understand is whether it would be a bull flag if the flag angled downward? As I see it trend is up and the pole plainly visible.

Second question, is there any significance to the minor slope differences between slight symmetrical triangle and a rectangle

which is how it has been described elsewhere?

Third, Is the best risk reward to wait for a breakout in either direction from this stalemate?

Fourth and final,in your first chart the white pattern,if I should choose to make a short term play is the best opportunity at point #4 or the retest that you mark with the white arrow?

Thanks in advance

Mark

Good Morning, Danny,

I'm not able to comment on that because I have no idea. I focus on what something IS DOING, and try to follow that, as best I can. I don't do any predicting.

Good Morning, Mark,

Question #1: The flag pole would have a "hook" in it, but the "flag part" (in yellow) still would have the same measuring implication if it broke out.

Question #2: I can see how someone would call the whole pattern at the top of the pole a Rectangle. The highs and lows are quite flat enough for me, but I have no problem with that.

It works better as a Flag or a Triangle, in my opinion, because those patterns gave us the validated trendline.

Question #3: If you don't have a position, yesterday's close was smack in the middle the recent trading, in "No Man's Land," so yes, it would be a good idea to wait for further developments.

Question #4: A break of the validated trendline would be a fine entry short, or you could wait to see yesterday's low (#4) get taken down for a short.

After a breakdown, if that should occur, a retest of the broken validated trendline, if there is a retest, also is a good entry short.

If you short it, be mindful that the trend IS bullish, so be vigilant.

Thanks again, I hope I don't impose on you too much.

Mark,

You're very welcome. I appreciate the fact that your questions always pertain to a stock or index under discussion, so it doesn't take me long to answer them.

Thank you for being so considerate of my time.

Hello Melf

I have been reading your blog for the last few weeks and 'joined' your group today. Thank you for taking the time and effort to post such lucid and informative material.

Good morning, Alex,

Thanks very much for the kind remarks, and welcome aboard!

Post a Comment