In yesterday's Comment Section, Mark said...

"There is a comment on the last diagram about not putting blue #4 in one spot vs. the other. How significant is that change? Both points are at almost identical levels."

Those points aren't as close as they might seem. Although the difference in the slopes of the two choices for the trendline is only about three cents per day, the "slight" difference each day amounts to about $1.20 differnce between where the two trendlines are today. More importantly, in my view, if we use the low where the black arrow is to draw the trendline, it slices through TWO candlesticks along the way, so I would question the significance of any breakdown below it.

In other words, we're looking for what Kevin was asking about yesterday: confirmation. If price breaks below "some" trendline, how do we know whether or not that trendline break is significant? How reliable would it be, shorting the break of "some" trendline, and/or shorting a retest of a broken trendline, expecting the trendline to become resistance?

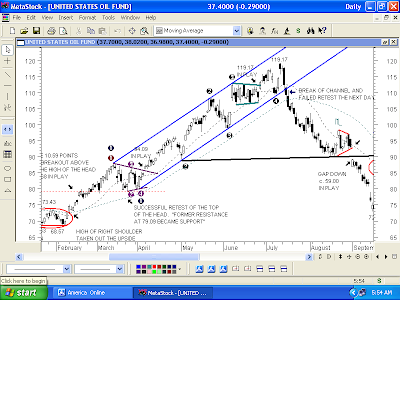

Let's start with this "blank canvas" of the USO last year, when it was "too high," "too overbought," "the greatest short of a lifetime," etc. Goldman was calling for $200 Crude Oil and "they were nuts for calling that!" A lot of shorts got squeezed half to death on those "emotional decrees," shorting the USO into mid-year, 2008.

As we've been doing with Goldman, let's take a more "sane" approach to charts, and try to identify some patterns and trendlines, to see if we can get anything that Ms. Market is telling us is significant because we know that she is the final arbiter of "what's too high" and "what's too low."

The initial pattern into mid-February, 2008 sure "looked like" a nasty H&S Top, and I remember reading things like, "That's it! The USO is done! I'm shorting the living you-know-what outta this thing! It has no business being this high!" LOL.

Any time that we see a putative Right Shoulder get taken out to the UPSIDE, and then also see the high of a putative Head of a H&S Top get taken out to the UPSIDE, oh, buddy, look out! The amount of points (10.59) that we obtained from measuring the height of the pattern so that we could subtract them when the neckline gets broken are ADDED to the high of the Head because it's a technical breakout alright, but it's a breakout to the UPSIDE, putting a target of 89.68 IN PLAY.

That's when we read, "I'm still shorting this stoopid thing. That's a false breakout! This thing is way-y over-valued, and it's going nuthin' but down...down...down...." and that's what helps to fuel a rally like the USO had in the Spring and Summer of 2008. The rally is met with disbelief and refusal to follow the trend.

Rather than listen to those "emotional decrees," let's try to listen to Ms. Market. Is she telling us anything significant? If she isn't, let's consider waiting and continuing to gather our "body of evidence" until she does tell us something significant.

After a significant run-up out of the H&S Top breakout, the USO went into a consolidation pattern, the Symmetrical Triangle in purple, which is typical of bull markets. The alternative to stopping to form a bullish continuation pattern in order to "consolidate the gains," is a Blowoff Top. That would be a parabolic rally that goes straight up. Those usually don't end well, and often result in a Parabolic Return all the way back to the origin of the Parabolic rally, so this forming of a "bullish continuation pattern" is very healthy for a chart, structually.

As any rally (or selloff) ensues, we want to use highs and lows to draw our trendlines. This is very important: We can connect ANY two highs or ANY two lows and call that a signifcant trendline, but we don't actually know if it is significant unless/until Ms. Market tells us that with a third "hit" to the trendline. That's called a validated trendline. There's no "always" in the stock market, but those validated trendlines usually have some signifance when they are broken. The longer that they are in place, and the more "hits" that there are to the trendline, the more significant they tend to be.

In this particular case of the USO, we got the third "hit" to the bottom of The Channel, at Black #3, on June 4, 2008, within a few cents. The USO gapped up in the next session, made a low for the day within a few cents of the validated trendline, and after planting a foot on that trendline, it shot up like a rocket to the top of The Channel where it found resistance at the trendline at the top of The Channel, also labeled Black #3, for another trendline validation.

Do you get the feeling that Ms. Market was trying to tell us something here, about the signifcance of trendlines of this Channel? LOL.

After finding validated resistance at the top of the Channel, the USO went into another Symmetrical Triangle which "should be" another bullish continuation pattern. Assume that the outcome will be bullish in a bullish trend, "until it ain't." The breakout put an upside target of 119.17 IN PLAY.

113.00 - high of the pattern

106.24 - low of the pattern

113.00 - 106.24 = 6.76 of upside from where the upper trendline was at the point of the breakout, which was 112.41.

112.41 + 6.76 - Target: 119.17 IN PLAY

After the pattern breakout, the USO had a selloff to fill the 110.40 gap from June 25, the day before the breakout. That accomplished TWO things: the gap got filled, and the low held above the bottom of The Channel at Black #4, for a SECOND trendline validation.

Off that second validation, the USO raced higher, and the target of 119.17 got MADE to the exact penny, and it also was THE HIGH for the USO.

That's very, very rare to get that kind of exactitude with a price target, and for it also to be THE HIGH, but it's a good example of the significance of that upper trendline of triangle (pattern in green), which we used to measure the target.

Two days after the 119.17 target got MADE, the USO has a significant close below the twice validated bottom of The Channel, which had been in tact for about three and a half months. The next session, the USO made a feeble attempt to rally back into the broken channel, but that failed, and we can see what followed.

Y-i-i-i-i-i-i-i-e-e-e-e-e-e!!!!!

When the USO broke down below The Channel on July 16, could we know for certain that it was going way-y-y-y down, to the low 20's? Certainly not. There are never any guarantees with these things. When it broke down, if we ask, "Are we sure that it's going down?" "What is the USO going to do now?" we're asking the wrong questions, because we can't know the answers to them.

The questions that we always need to ask, because we CAN answer them, are:

1. Do we want to short the breakdown of a three and half month channel? Answer: Yes, please.

2. If so, how are we going to structure a trade?

a)Where would we put our stop? (Answer: a close back inside the channel probably would be a good idea, and re-enter short on another break below it).

b)Where are we going to take profits? (Black #3, at the bottom of the channel, would be a good place to take some, then at Black #2, at the bottom of the channel. Those are "horizontal support" levels).

Bottom line: Those validated trendlines aren't a guarantee, but they sure can be helpful if we know where they are, and when they are broken. Go back and look at the "blank canvas," the first chart above, and try to figure out what's going on without the trendline :)

====scatching my head, looking clueless====

2 comments:

I really appreciate your taking the time and effort to assist in my education. Many Thanks

Good Morning, Mark,

Your very welcome, my friend ;)

Post a Comment