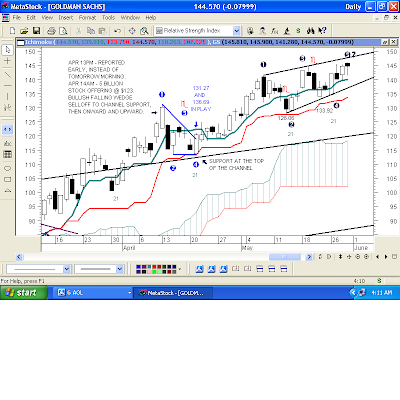

From Friday morning's analysis on GS:

"How many times have we referred to Goldman as "The Stock That Refuses To Die?"

Looking at the final hour of trading on Friday, I'd have to say "The Stock that STUBBORNLY refuses to die!" LOL.

Lest anyone misinterpret my joking, I want to be clear that I have been describing Goldman that way as an expression of repect for how strong it has been off its autumn low (same for Morgan). In my view, any opinion or feelings that we have about companies are best left for Cocktail Hour conversation, and left out of our trading. What I call "vengeance trading," or "vendetta trading" out of anger doesn't serve us very well, and certainly hasn't over the past several months, in particular.

Rather than get angry, and I do understand peoples' anger with Goldman and with the market in general, I find it better to steel ourselves to our emotions with our trading, and to look for EVIDENCE that we've got a case for shorting a stock, if that's what we want to do. Let's look at Friday's trading in Goldman, as an example.

We came into Friday's session on a Bearish Rising Wedge (pattern in white), a "fractal" (just means a "repeating pattern") of the Bearish Rising Wedge that has formed in the daily chart. Goldman gapped up out of The Wedge to a new high for the move, in sympathy with Keefe, Bruyette & Woods' upgrade of Morgan, but immediately came down hard, and down through the bottom of the Bearish Rising Wedge. That's known as a "Gap And Crap Reversal." Gap up and fizzle, back through the bottom of the pattern, and it was on volume, suggesting that Goldman was in for a rough session. UGH.

Where is resistance on a reflex rally off the initial breakdown low?

1. 143.63 - That's first horizontal resistance, at the low of The Wedge (White #2).

2. 144.14 -144.14 - Identical lows, at White Data Point #4.

3. 144.52 - 144.53 - 144.53 - 144.53 - the near-identical "last lows" of the 5-Minute bars, going into Thursday's close.

4. Trendline #2 - #4, which is rising a bit every 5-Minutes.

Have we got reason to short Goldman on a reflex rally? Yes. Why?

1. Gap And Crap opening.

2. Fakeout Breakout of The Bearish Rising Wedge and downside reversal through the bottom of the pattern, on volume

3. Bearish Rising Wedge in the Daily Chart, on weakening technicals.

Are we "predicting" anything? No. We're LOOKING at what already happened, and we're deciding if we can structure a good risk:reward for a trade.

My personal choice was to try to short Goldman below Thursday afternoon's late afternoon 144.52, 144.53, 144.53, 144.53 5-Minute bar lows. I picked 144.45. Stop: above the 145.29 Thursday aftenoon high of the Bearish Rising Wedge, at White Data Point #5. Risk: $0.84. Reward: at least double that, depending on how trading ensued.

Obviously, my order didn't get filled. The Reflex Rally high was 114.13, one penny below the identical 144.14 - 144.14 lows at Data Point #3, and down she went to a new low on the session, at Red Data Point #1.

From there, we can see that a Symmetrical Triangle (pattern in red) emerged, which "should have" a bearish resolution because of the Gap And Crap Reversal. It did. Goldman broke below it, rallied back inside it, broke below it again, and the next rally was a failure at the bottom of the pattern, at 143.09 (red arrow) validating it as resistance. Down she went to a new low, at Yellow Data Point #1.

Raise stops to above the 143.89 high of the pattern (Red #2).

From there, Goldman rallied to 143.09 exactly, at Yellow Data Point #2. Another Symmetrical Triangle pattern (in Yellow) emerged. Goldman broke below that, and sank to another new low on the session, establishing 143.09 at DOUBLE validated resistance:

1. The retest of the Red Symmetrical Triangle failed at 143.09.

2. The high of the broken Yellow Symmetrical triangle failed at 143.09.

Raise stops to an upside takeout of 143.09. Anyone who shorted the Bearish Rising Wedge breakdown, or who shorted the Reflex Rally back toward the breakdown now has locked in a winning trade.

What can we say about the Bull Stampede/Short Squeeze that began just before we turned for home for the final hour of trading? One thing that I'd say for sure is that, if you shorted in the morning, get the heck outta there on the upside takeout of 143.09. Ms. Market had told us very clearly that it was DOUBLE RESISTANCE, and when resistance isn't any longer resistance, it's a good idea to pack it in and "take the money!" Now, I'm talking about this specific trade off the 5-Minute chart. Swing traders likely are using Friday's high, or the Bearish Wedge trendline in the daily chart as their stop.

There is discussion this weekend about the late afternoon "ramp up" and an end-of-month "market manipulation" I doubt that any of that discussion is coming from Bulls. LOL. Let's be honest about that. Regardless, of "the reason" for the late afternoon rally, did Ms. Market CLEARLY tell us that an upside takeout of 143.09 "might be" important, or not? I think that she did, but I won't argue with anyone about it. Waste of time ;) While I wouldn't argue, I might say, "Quit yer whining and play it as it lies." (Cranky old man) LOL.

Congratulations to anyone who read this far, and my apologizes for the length and detail of this post. The purpose of it was to demonstrate the wealth of information that Ms. Market gives us if we try our to best to FOLLOW along. I also wanted to point out that, although Ms. Market isn't exact with these numbers, she sometimes is, or comes mighty close (the boldfaced numbers above.) Ms. Market rules, whether we like it or not, and if she hasn't humbled us yet for trying to act smarter than she is, she eventually will ;)

Quickly, since this is so long-g-g...

Basis the daily chart, Goldman still is inside the Bearish Rising Wedge, so the jury still is out. Friday's candle is a possible Bearish Hangman, but no guarantees that it will break down. For example...

...not only did the Bearish Rising Wedge in the USO resolve to the upside, so did the Rising Channel. Granted, Friday's candle sure looks like a Bearish Hangman, but let's remember that Wednesday's candle at the top of the Bearish Rising Wedge sure "looked like" a Bearish Doji Star Hangman. It wasn't.

Although the majority of Bearish Rising Wedges do resolve to the downside (I don't know the percentages, but Bulkowski might have something on that), this is a fine example of how there is no "always" in the stock market.

5 comments:

Kevin,

Thanks for the kind words. I'm glad if any of my work has helped you and hope that this morning's review of Friday's trading in GS gives you a few ideas about the kinds of things to look for in the days ahead.

Good luck with your GS trade, and with all of your trading.

Hi Melf,

I was wondering if you had any thoughts about the closing action on Fri.? EOM usually has an upward bias due to marking up but I am concerned about the Leveraged ETFs rebalancing in the last hr and the bots sensing a pattern and pushing it. Am I correct in believing that there is no real selling vol. the market is finally reaching the 200DMA. It had been 20+% beneath. Couldn't it react somewhat over the 200DMA?

Melf

I appreciate the followup post on GS. It's amazing how much you can see in the seemingly random movements in the charts. I am intending to use the upper trendline of the bearish wedge as my stop. Obviously, I'd prefer a break of the lower trendline, though.

Mark,

Much is made of overhead 200DMAs being resistance, and of Bullish and Bearish Crosses of the 50 and 200 DMAs. I've never found any hard and fast rule about those things that is reliable, or even very helpful. I show you an example of what I mean in this morning's post.

------------

Kevin,

Good for you with the stop. That's very important. There's a fellow on the net named Oscar, who has a web site about trading futures. He has a saying, "Stops are in...emotions are OUT." I very much like that. It doesn't have to be a hard stop (one that you actually enter), but "some" level at which we say, "Okay, I outta there."

We aren't going to win them all, so we want to cut out losses if a trade goes against us, and stick around to play another day.

Good luck with GS, and if the trade doesn't work, you'll find one that will.

the early bird gets the worm, i see. Futures indicate huge upside, maybe my trade will end sooner than later...

Post a Comment