"Don't let anyone tell you that these 2X and 3X ETFs can't be charted. There are patterns that emerge from time to time that are just as valid as those in any other chart. Both the Bullish Inverse H&S target of 81.94 and the Bearish H&S Top target of 66.50 got MADE."

I'm still being told that these things can't be charted, or that they shouldn't be charted, or that it's a waste of time to chart them, and even was told that I'm giving technical analysis a bad name by trying to chart them at all! SIGH...

Rather than get irritated, like I did last night, I'm going to take my time to go over the chart of the SKF for the past year that I have presented here and elsewhere during the course of that time, and if anyone wants to remain ignorant about the value in charting these things, I'm gonna let 'em remain ignorant. "You can ride a mule to water, but you can't make him drink." I actually prefer, "You can ride a mule to water, but fer gawd sakes, don't drag your F***ING feet." I try not to cuss, though. LOL.

Here we go...

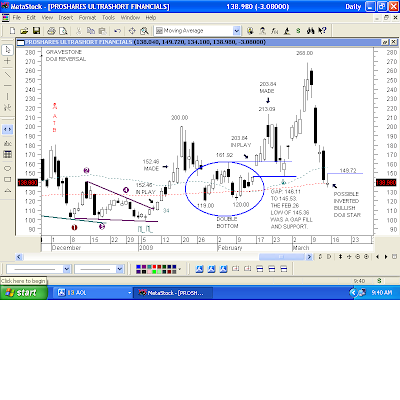

This first chart looks like I threw a pizza pie at it. I just want you to get an overview of the FIVE bullish patterns that we're going to zoom in on, and I also want you to get an idea of how volatile these ETFs are, if you aren't already. More like violent.

The first two patterns are back-to-back Bullish Wolfe Waves, and don't be intimidated if you don't know what a Wolfe Wave is. Basically, a Wolfe Wave has a strong directional move (Lead-in), then goes into a channel that is in the same direction as the lead-in. The KEY ELEMENT is the Wave 5 Fakeout that puts the proverbial "everyone" wrong-footed at exactly the wrong time. When "the deception is exposed," the stock (or ETF) rips in the opposite direction toward the target line, at #6.

Look at Blue #5, the Wave #5 Fakeout/Breakout last May. Longs are inclined to sell that break of the channel, and shorts are inclined to sell short the breakdown. "Everyone" is a seller, and at exactly the wrong time.

The SKF reversed, went up to the top of the channel and temporized there a bit, then broke out of the channel. The measured move just off the channel measurement put a target of 146.20 IN PLAY. The Wolfe Wave target line at Blue #6 is derived by connecting the low of Wave 1 and the high of Wave 4. The target line often looks like an impossibilty on the upside because it can be so steep, like this one is, but makes sense in that it shows us HOW wrong "everyone" got it at the Wave #5 Fakeout/Breakdown.

The second Bullish Wolfe Wave had TWO downside fakeouts. The second one was a case of the fundamentals trumping the technicals when shorting the financials was banned. By the way, look how close the candle of September 18 came to the Wave #6 target line before the big reversal into the close. I'm not accusing anyone, but "sumbuddy knew sumpthin'" before the announcement ;)

The September 19 Gap Down opening from $115 to $87 was absolutely brutal for SKF longs, but that DOUBLE Wave #5 Fakeout/Breakdown accomplished its mission by putting the "provebial" everyone wrong-footed! In this case, it might be fair to say "literally" everyone. But, "markets are going to do what markets are going to do." DURING the ban on shorting financials, the SKF, a 2X short financials that NOBODY wanted to be long, rallied during the ban, and the Wolfe Wave target got MADE the day after the ban was lifted. Certainly not what the majority expected.

The Symmetrical Triangle (in blue) was very wide-swinging. Big moves in both directions before it broke out to the upside. There was a reversal back inside the pattern the day after it broke out, testing the mettle of anyone long, but then it ripped to the upside, going well beyond the target.

The little pattern in purple is a Bullish Falling Wedge, technically, because of the "lower lows," but it has the look of a Descending Triangle with a Triple Bottom. When it broke out, the SKF ripped to the upside and went well beyond its target again.

Last pattern...the Double Bottom. Very straight forward. It broke out and went directly to the target. Notice the gap fill and bounce off that, on February 26. That gave the suggestion of a retest of the 213.09 high. The SKF went much higher than that, until the TRIPLE nested H&S Top (best seen in the hourly) that I posted on Tuesday morning (see that post, if interested).

Personally, I have found charting these 2X and 3X ETFs to be more of a useful adjunct in my trading of my poster children for "Bad News Is Good News," Morgan and Goldman. A lot of nice patterns in both of those charts.

In Morgan, on December 4, the Bullish Falling Wedge target of 24.52 went IN PLAY. On December 17, the Bullish Inverse H&S pattern of 25.34 went IN PLAY. There were two intervening Bearish patterns, the H&S Top and the Bear Flag (all of those targets got MADE), and on Friday, the 24.52 and 25.32 targets both got MADE.

In this wickedly bearish environment, whoda thunk that Morgan would have rallied 285% off its October low? Whew! But, the TRIPLE nested H&S Top in the SKF certainly suggested that getting to these two Morgan targets was possible.

9 comments:

thank you for your work it's great, are thinking bullish for SKF now ? abd FAZ, if so what are your targets

thanks

To my eyes, it looks like we might have a pullback for the financials in store? MS is also sitting very near it's average analyst target, which I've found useful for spotting shorting opportunities, I guess all the fundamental investors have their eyes on these targets.

Typo in the last paragraph on the post, you said Goldman, but meant Morgan Stanley.

Melf,

Thank you so much.

What a relief to hear from you that SKF CAN be charted. :)

Those Wolfewaves seem to be quite useful on them too (wink).

Most likely, I will try to look for more of those Wolfewaves in the smaller timeframes.

Thanks for pointing out that inverted doji bullish star (I wrote it as an inverted hammer in my annotation).

Thanks for reply on x-trend, I like to ask you few ideas to be a full time trader soon, geting layoff package from Intel. Please see if we can chat on my gmail email. Hope I am not bothering or asking much.

rguptadg@gmail.com

I was using scottrade, switch to zeco and TOS now, I like your charting platform too, is it Globex? I use stockcharts pescription services and learn most of my TA seeing others do and read book at Borders. I bought few that did not help, someone gave me Pristine tapes at MIT. That helped. I am in Boston area and got to IBD group meetings at MIT but x-trend is the best place to meet like minded people.

http://tradeinmarket.blogspot.com/

my blog I plan to use soon more often.

I need to develop stretegy that gives me income. I am single and have time.

rguptadg@gmail.com

Thanks Rakesh

Melf,

There looks to be a possible Wolfewave #5 in the making on SKF.

Not sure if the symmetry qualifies for it.

I need a second opinion.

I've recently changed the settings on my blog and disabled the word verification feature.

For now, I'm also allowing anonymous comments.

Hey, guys!

Thanks for the responses. I apologize if this seems ungracious or ungenerous, but my time contraints don't permit me to engage in e-mailing or to answer questions about specific stocks, other than questions pertaining to what I have posted here. If I do that, I'm going to be swamped, and I'm sure that you can appreciate the time involved in doing that. Thanks for your understanding.

I'm a trend follower. I don't have a clue what the SKF is going to do next. Rather than try to "make a call" about what something is going to do (that's predicting), I look at what a chart IS DOING (that's following).

If I've got a pattern, like I've described in just about every post here over the past year and a half, I describe what target is IN PLAY. Those targets don't always get MADE. There's no "always" in the stock market. But, many of them do get MADE.

Suggestion: If you're interested, go back and read some of the past posts and learn the patterns and how the targets are derived (I've shown the math in quite a few posts).

My purpose in this blog is to share the information about the patterns, trendlines, support and resistance, etc. and if you want to stop by here once in ahwile, and hopefully learn something in the process, that would be great.

Rakesh,

I use Metastock for my daily charts. The intraday charts are Scottrade, which I like very much. Very fast executions.

----------

Susannah,

Good observation about Morgan getting close to the analysts' price targets. Also, often when targets get MADE, like the two in Morgan on Friday, it does have a reversal of some kind. We've seen that a lot lately in the charts that I've posted. Some have been within pennies. A reversal isn't anything automatic, of course. Sometimes, targets are exceeded by a good bit, like the ones in the SKF that we just looked at.

I'd suggest looking at intraday charts in Morgan for any sign of a reversal, like the TRIPLE nested H&S Top in the SKF earlier in the week in the 10-Minute chart.

Thanks for catching the typo. I do that all of the time with Goldman and Morgan, dang it ;)

------------

jegejig,

The huge smackdown in the SKF does suggest that it's a "possible" Lead-in for a bullish Wolfe Wave, doesn't it? Charts often exhibit "fractal" behavior, simply meaning patterns that repeat, like the back-to-back Bullish Wolfe Waves in the SKF last year. Sure would be interesting if we get another one ;)

Scottrade is down for maintenance at the moment, so I'll have to look at the intraday charts later on. What time-frame are you using?

------

ikutek,

I don't have any targets in either the FAZ or the SKF. At the moment, the freefall to the downside has stopped, but they're still bearish. That doesn't mean that they won't do something bullish next week, but I can't know that. Remember, I try to follow the market. I'm lousy at predicting anything.

Good luck, everyone!

Melf,

"

jegejig,

The huge smackdown in the SKF does suggest that it's a "possible" Lead-in for a bullish Wolfe Wave, doesn't it? Charts often exhibit "fractal" behavior, simply meaning patterns that repeat, like the back-to-back Bullish Wolfe Waves in the SKF last year. Sure would be interesting if we get another one ;)

"

I'm looking at the daily chart.

If my count/analyis of both the Wolfewave #5 and Elliot wave #5 are correct, SKF may surpass the 268.00 swing high.

Charts are posted in my blog.

jegejig,

Okay, I looked at your charts. We'll see how it plays out. Thanks.

Post a Comment